JPMorgan CEO Jamie Dimon said that holding gold makes some sense, but he refused to reveal whether he believes gold prices are overvalued after their historic rise.

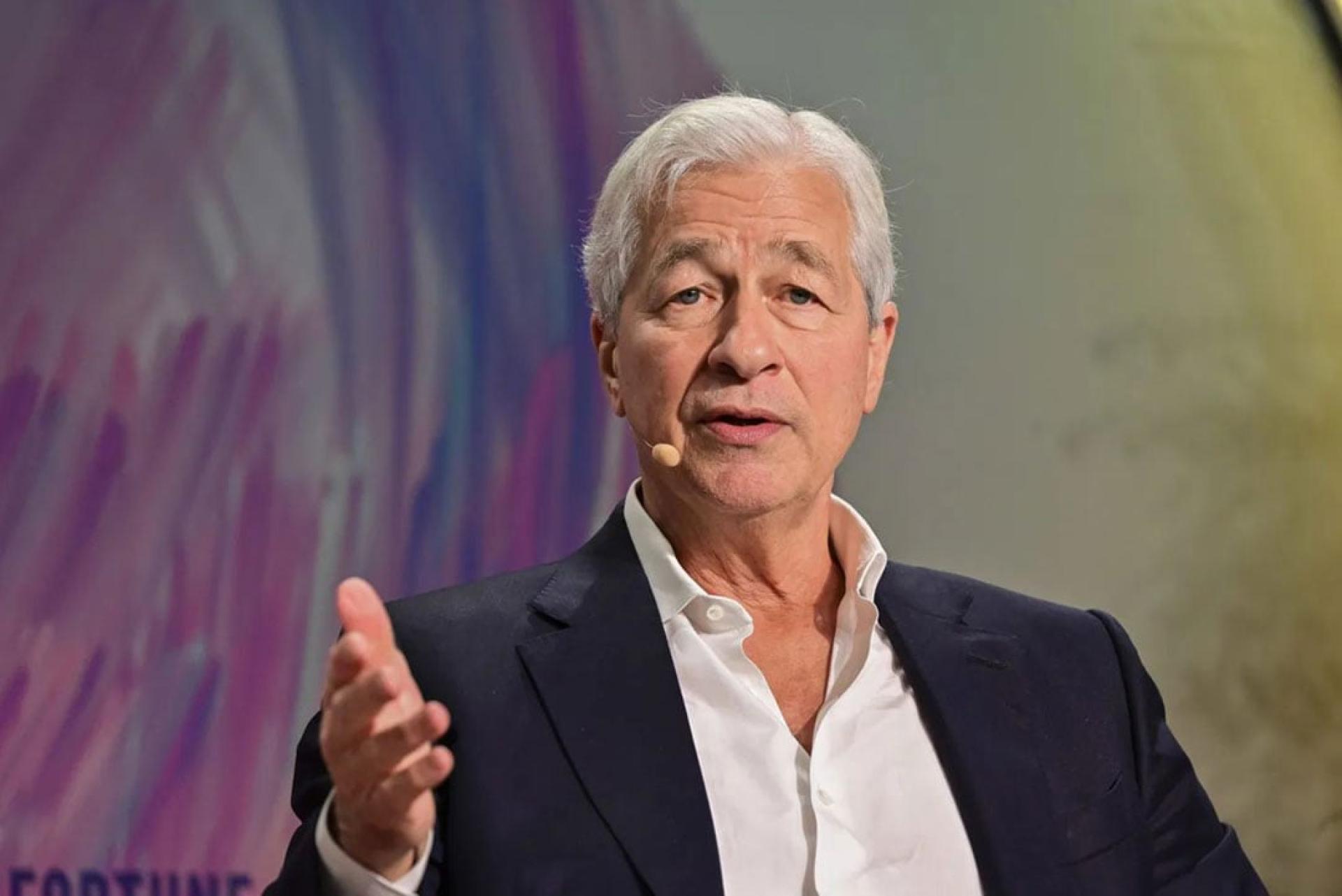

According to Bloomberg, Dimon said on Tuesday at Fortune’s Most Powerful Women Summit in Washington, “I’m not a buyer of gold—the cost of holding gold is 4%,” and pointed out, “In this environment, gold prices could easily soar to $5,000, or even $10,000.” He added that in his life there have been only a few occasions when holding some gold in an investment portfolio was “semi-rational.”

In addition, he noted that “asset prices are a little high,” which has affected almost all sectors at present.

The report mentions that gold prices were still below $2,000 two years ago, but so far this century, gold has risen more than the stock market, reflecting investor demand for safe-haven assets amid concerns over inflation and geopolitical turmoil. Last week, Citadel founder Ken Griffin also said that investors are beginning to consider gold safer than the U.S. dollar, calling this development “truly worrying.”