China has signed social security agreements with 13 countries to assist enterprises in exploring international markets.

According to a report by The Paper on the 29th, China’s Ministry of Human Resources and Social Security (MOHRSS) held its third seasonal press conference on the 29th. Wang Tao, Level II Inspector of the Department of International Cooperation, stated that with the deepening development of economic globalization, cross-border investment and operation by enterprises as well as cross-border labor mobility have become increasingly frequent. Multinational enterprises and employees may face the issue of double payment of social insurance fees in both the dispatching country and the host country.

To address this problem, a common international practice is to negotiate and sign social security agreements. These agreements specify that personnel who have already participated in social insurance in one contracting country may be exempted from the obligation to pay the corresponding social insurance fees in the other contracting country within a stipulated period. Since 2001, China has successively signed bilateral social security agreements with 13 countries: Germany, South Korea, Denmark, Finland, Canada, Switzerland, the Netherlands, France, Spain, Luxembourg, Japan, Serbia, and Kyrgyzstan.

Among them, the China-Kyrgyzstan social security agreement officially came into force on October 14 of this year. On this, Wang Tao pointed out that in recent years, the high-quality and deepening construction of the Belt and Road Initiative between China and Kyrgyzstan has made steady progress, with strategic projects such as the China-Kyrgyzstan-Uzbekistan Railway and Biedieli Port advancing rapidly, and bilateral exchanges and cooperation expanding across various fields. Currently, there are 85 Chinese-invested enterprises in Kyrgyzstan and more than 9,000 Chinese personnel employed there. Most of these personnel have already paid the relevant social insurance fees in China and face the problem of double payment while employed in Kyrgyzstan.

The "China-Kyrgyzstan Social Security Agreement" consists of 25 articles, and its core content can be summarized as "three clarifications." First, it clarifies that the type of insurance mutually exempted is pension insurance: for the Chinese side, this includes urban employee (resident) pension insurance and basic pension insurance for urban and rural residents; for the Kyrgyz side, this includes old-age, disability, and survivor insurance not covered by the state budget. Second, it clarifies the coverage of mutually exempted persons, specifically, dispatched personnel, self-employed individuals, employees on sea vessels and aircraft, international transport company personnel, civil servants, members of diplomatic missions, and consulates working in the other country. Third, it clarifies the method of implementation. The competent authorities of both sides sign an administrative agreement to determine the implementing agencies responsible for information exchange, issuing certificates of coverage, and other related matters.

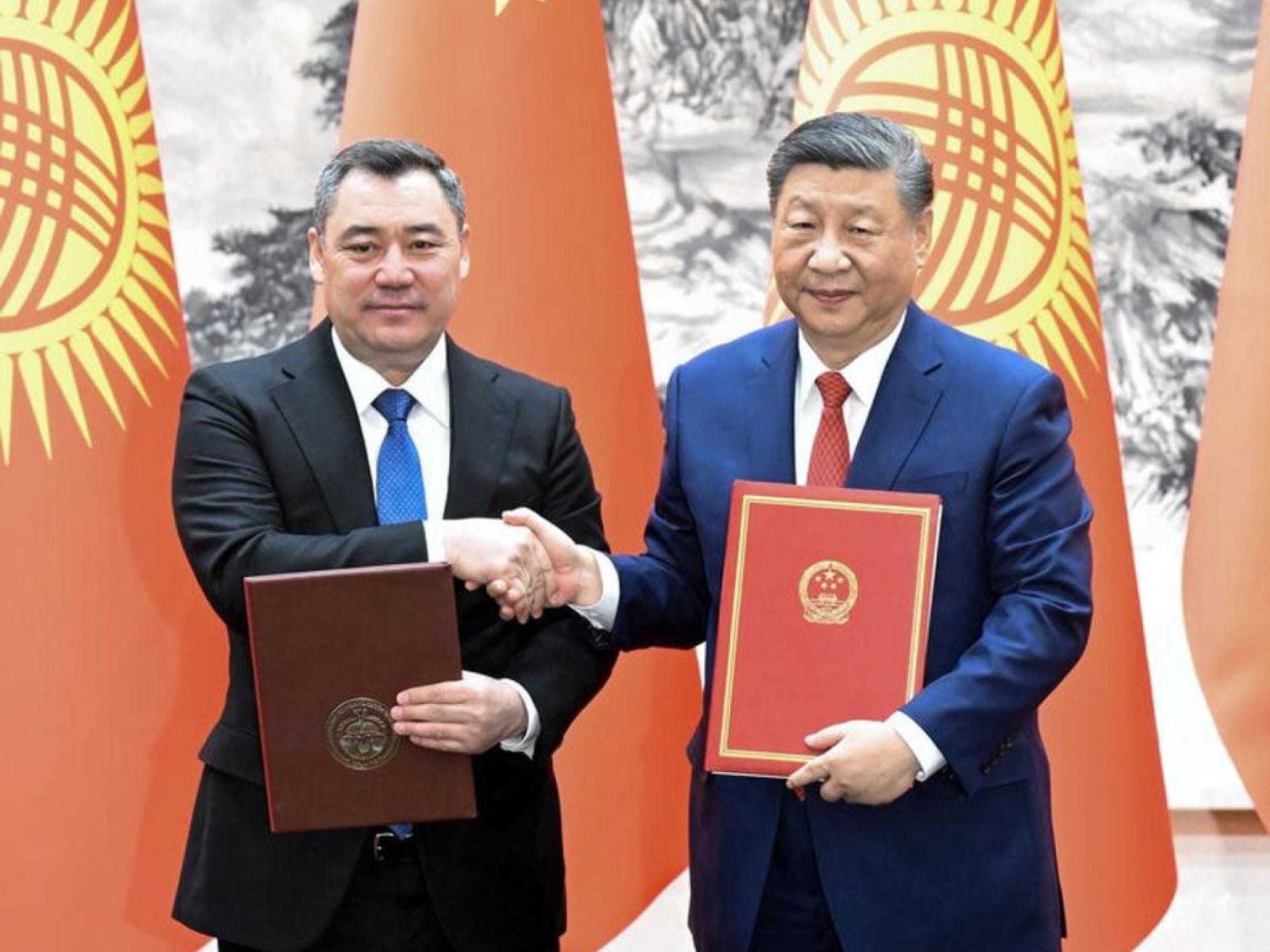

Wang Tao stated that the China-Kyrgyzstan social security agreement is the first of its kind signed with a Belt and Road Initiative partner and witnessed by the heads of state. It marks a new chapter in China–Kyrgyzstan cooperation and exchanges in social security. The signing and implementation of the China-Kyrgyzstan social security agreement will effectively protect the rights and interests of cross-border employees of both sides and effectively lower business operating costs for both parties in the other's country.