(Jakarta, Bloomberg) The Indonesian government has decided to withdraw 75 trillion rupiah (about S$5.77 billion) in cash that was originally planned to be deposited in state-owned banks, after assessments by the Ministry of Finance showed that such deposits would do little to spur credit growth.

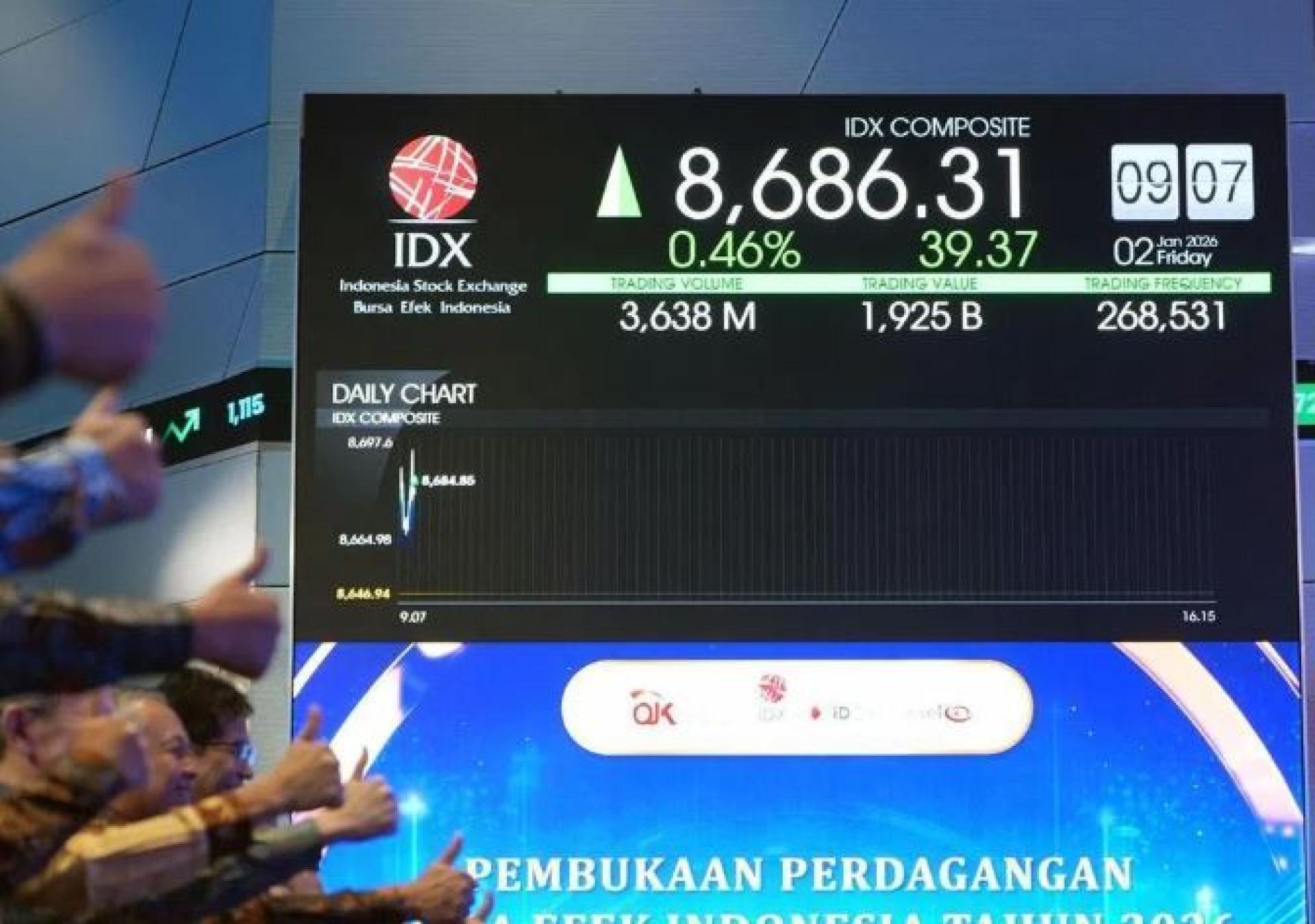

At the Jakarta stock market opening ceremony on January 2, Finance Minister Purba Yani stated that the funds would be reallocated to central and local governments for immediate economic activities, thus not affecting money supply, and could instead generate a positive multiplier effect.

Since taking office four months ago, Purba Yani had placed 276 trillion rupiah of government cash reserves in six state-owned banks to encourage them to increase lending and stimulate economic growth. Usually, the government uses its cash for liquidity needs, emergency spending, or to cover budget deficits.

He pointed out that the previous deposits in state banks did not stimulate loan growth as expected, mainly due to a lack of coordination with central bank policies.

Indonesia's central bank previously stated that last year's weak lending reflected constraints on the demand side rather than a lack of banks’ lending capacity, and predicted that 2025’s annual loan growth would be near the lower end of its 8%-11% target. The central bank noted that high borrowing costs have led companies to take a wait-and-see attitude and rely more on internal financing.

Mohit, senior partner at SGMC Capital, believes that redirecting funds from state banks to fiscal spending will help boost economic growth, as government spending usually creates a greater economic multiplier effect than idle liquidity in the banking system.